A Complete Guide for Foreign Financial Companies Entering Saudi Arabia (2026)

Saudi Arabia is entering a fintech hyper-growth era under Vision 2030 — but foreign companies must meet strict SAMA and PDPL data residency requirements to operate in the Kingdom.

Saudi Arabia is the fastest-growing financial market in the Middle East — but SAMA compliance, data residency, and in-Kingdom cloud requirements are far stricter than EU/US standards. Here is what foreign fintechs, banks, insurers, and payment companies must know before expanding into Saudi Arabia.

Saudi Arabia is building one of the most modern and ambitious financial ecosystems in the world — and global players are taking notice.

The scale of opportunity is unmistakable:

US$1+ trillion in banking assets (2023), heading toward ~US$1.3T by 2025

35M+ population, majority young and digitally active

Smartphone penetration among the highest globally

Retail e-payments now >70% of all transactions (79% in 2024)

Fintech funding exceeded US$791M in 2023, with >US$1.1B raised since 2020

Vision 2030 targets over 525 fintech companies by 2030

For foreign banks, payment processors, digital wallets, remittance players, insurers, and open-banking platforms — Saudi Arabia represents one of the largest financial expansion opportunities this decade.

But the gateway is SAMA, and compliance expectations are more demanding than most Western institutions anticipate.

This guide explains what SAMA is, how Saudi requirements differ from EU/US frameworks, and what foreign companies must prepare before entering the Kingdom.

Why Saudi Arabia Is a Market You Can't Ignore

1. Young, Digitally-Driven Population

35M+ population

Over 60–70% under age 35

High smartphone adoption and digital banking usage

Result: Rapid adoption of digital wallets, BNPL, remittances, and neo-banking.

2. Vision 2030: A Government-Driven Financial Revolution

Saudi Arabia is not waiting for financial innovation — it is actively legislating and funding it.

Key initiatives shaping the market:

InitiativeImpactSaudi Fintech Initiative & funding programsCapital & licensing supportOpen Banking FrameworkMandatory APIs & interoperabilityRegulatory Flex-SandboxControlled fast-track for new fintech modelsDigital Payments MandateCashless shift across government servicesForeign investment & tax incentivesEncouraging global entrants

The result is a policy-backed, innovation-friendly environment designed to attract foreign players who can bring technology and expertise.

3. Underserved Segments with High Growth Potential

Opportunities exist across multiple domains:

1) Payments & Fintech

Cross-border remittance (~US$40B+ annual flow)

Digital wallets adoption booming

BNPL growing >60% YoY

Embedded finance in early phase

2) Banking

Digital banks emerging

SME banking demand rising

Islamic finance product innovation

Wealth management for affluent demographics

3) Insurance

Insurtech penetration still low (~2.8% of GDP)

Embedded & micro-insurance opportunities

Health insurance growth driven by regulation

This is a market where demand exceeds supply — ideal for new entrants.

4. GCC Expansion Hub

Success in Saudi often becomes a launchpad to:

UAE → Kuwait → Bahrain → Qatar → Oman

Saudi sets regulatory tone for the region — win here, scale across GCC more easily.

The Reality: Massive Opportunity Comes with Regulatory Complexity

Many European and American fintechs enter Saudi assuming compliance transferability.

It doesn't transfer automatically.

Saudi Arabia emphasizes data sovereignty, localization, and regulator visibility far more strictly than EU/US frameworks like GDPR or DORA.

What Exactly Is SAMA?

SAMA = The Saudi Central Bank

Regulates:

Banks & digital banks

Fintech & payment service providers

Insurance companies

Remittance & FX platforms

Credit bureaus

Finance companies

Open-banking & payment institutions

If you handle financial data or money in Saudi Arabia — SAMA regulates you.

Why Foreign Companies Are Often Surprised

1. Data Localization Is the Default, Not the Exception

In the EU:

Data can move cross-border if safeguards exist (SCCs / adequacy / BCRs)

In Saudi:

Financial & personal data must be stored and processed inside the Kingdom. Cross-border transfer is allowed only with strict justification and controls.

This changes cloud strategy, architecture, IR/DR planning, and operational models.

2. Cloud Deployment Must Be Saudi-Specific

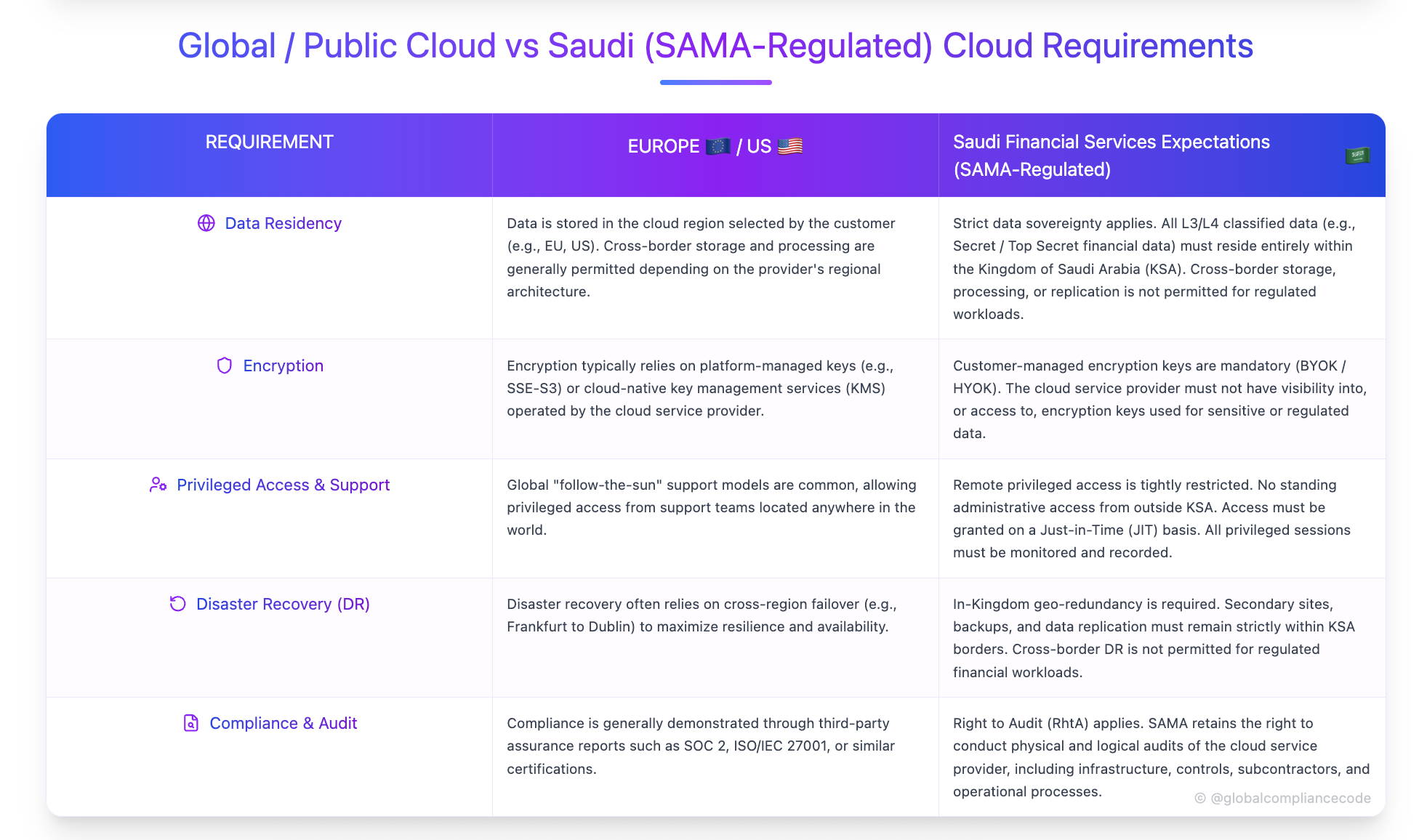

Global / Public Cloud vs Saudi (SAMA-Regulated) Cloud Requirements

1. Data Residency

Global / Public Cloud

Data is stored in the cloud region selected by the customer (e.g., EU, US). Cross-border storage and processing are generally permitted depending on the provider’s regional architecture.

Saudi / SAMA-Regulated Cloud

Strict data sovereignty applies. All L3/L4 classified data (e.g., Secret / Top Secret financial data) must reside entirely within the Kingdom of Saudi Arabia (KSA). Cross-border storage, processing, or replication is not permitted for regulated workloads.

2. Encryption

Global / Public Cloud

Encryption typically relies on platform-managed keys (e.g., SSE-S3) or cloud-native key management services (KMS) operated by the cloud service provider.

Saudi / SAMA-Regulated Cloud

Customer-managed encryption keys are mandatory (BYOK / HYOK). The cloud service provider must not have visibility into, or access to, encryption keys used for sensitive or regulated data.

3. Privileged Access & Support

Global / Public Cloud

Global “follow-the-sun” support models are common, allowing privileged access from support teams located anywhere in the world.

Saudi / SAMA-Regulated Cloud

Remote privileged access is tightly restricted.

No standing administrative access from outside KSA

Access must be granted on a Just-in-Time (JIT) basis

All privileged sessions must be monitored and recorded

4. Disaster Recovery (DR)

Global / Public Cloud

Disaster recovery often relies on cross-region failover (e.g., Frankfurt to Dublin) to maximize resilience and availability.

Saudi / SAMA-Regulated Cloud

In-Kingdom geo-redundancy is required.

Secondary sites, backups, and data replication must remain strictly within KSA borders. Cross-border DR is not permitted for regulated financial workloads.

5. Compliance & Audit

Global / Public Cloud

Compliance is generally demonstrated through third-party assurance reports such as SOC 2, ISO/IEC 27001, or similar certifications.

Saudi / SAMA-Regulated Cloud

Right to Audit (RhtA) applies.

SAMA retains the right to conduct physical and logical audits of the cloud service provider, including infrastructure, controls, subcontractors, and operational processes.

The Core Regulatory Pillars You MUST Understand

The Core Regulatory Pillars You MUST Understand

Foreign entrants must assess compliance readiness across five key frameworks:

Note: CCRF is issued by CST, not SAMA — but SAMA requires financial institutions to comply with it, making it critical for cloud deployments.

SAMA vs DORA: A Helpful Comparison for European Companies

DORA (EU) vs Saudi SAMA + CCRF/PDPL compliance requirements comparison for cloud service providers and financial companies.

Highlights key differences in data residency, disaster recovery expectations, log/backup location requirements, outsourcing controls, and foreign administrator access rules.

Common Mistakes Foreign Entrants Make

❌ 1. Building in UAE/Bahrain and routing Saudi users through it

Licenses get delayed — often forced to rebuild inside KSA.

❌ 2. Presenting ISO 27001 / PCI as “enough”

They are baselines — not substitutes for Saudi-specific requirements.

❌ 3. Treating compliance as post-launch work

SAMA expects detailed architecture, data flows, DR evidence, vendor governance upfront.

Delays often add 6–18 months of cost and redesign.

Cost vs Reward — Is It Worth It?

Typical investment ranges for serious entry:

But ROI potential:

Access to US$1T+ financial sector

High-value premium customers

Early-stage competitive landscape

GCC expansion multiplier effect

For committed players — the business case is strong.

Key Takeaways

1. Saudi is one of the most important financial markets of 2025–2030

Big, young, digital, high-value.

2. SAMA operates differently from EU/US regulators

Localization & sovereignty first — not portability.

3. EU/US compliance is helpful but not enough

DORA/ISO/PCI ≠ ready for licensing.

4. Build Saudi architecture from day one

Not “extend later” — design for in-Kingdom from start.

5. Compliance is a competitive advantage

Those who adapt early scale fastest.

References & Source Materials:

Saudi Central Bank (SAMA) — Cybersecurity Framework

Personal Data Protection Law (PDPL)

National Cybersecurity Authority (NCA) — Essential Cybersecurity Controls (ECC-2)

Communications, Space & Technology Commission (CST) — Cloud Computing Regulatory Framework (CCRF)

Disclaimer

This guide is provided for informational purposes as a reference to official NCA publications. The Arabic version of ECC is the legally binding text for all matters relating to meaning or interpretation. Organizations should consult the official NCA documentation and seek professional guidance for compliance implementation.

Global Compliance Code provides vendor-neutral, source-based regulatory reference materials. All content is derived from official regulatory publications.