A Complete Guide for Foreign Financial Companies Entering Saudi Arabia (2026)

Saudi Arabia is entering a fintech hyper-growth era under Vision 2030 — but foreign companies must meet strict SAMA and PDPL data residency requirements to operate in the Kingdom.

Saudi Arabia is the fastest-growing financial market in the Middle East — but SAMA compliance, data residency, and in-Kingdom cloud requirements are far stricter than EU/US standards. Here is what foreign fintechs, banks, insurers, and payment companies must know before expanding into Saudi Arabia.

Saudi Arabia is building one of the most modern and ambitious financial ecosystems in the world — and global players are taking notice.

The scale of opportunity is unmistakable:

US$1+ trillion in banking assets (2023), heading toward ~US$1.3T by 2025

35M+ population, majority young and digitally active

Smartphone penetration among the highest globally

Retail e-payments now >70% of all transactions (79% in 2024)

Fintech funding exceeded US$791M in 2023, with >US$1.1B raised since 2020

Vision 2030 targets over 525 fintech companies by 2030

For foreign banks, payment processors, digital wallets, remittance players, insurers, and open-banking platforms — Saudi Arabia represents one of the largest financial expansion opportunities this decade.

But the gateway is SAMA, and compliance expectations are more demanding than most Western institutions anticipate.

This guide explains what SAMA is, how Saudi requirements differ from EU/US frameworks, and what foreign companies must prepare before entering the Kingdom.

Why Saudi Arabia Is a Market You Can't Ignore

Saudi Arabia is one of the fastest-growing fintech markets globally, supported by Vision 2030 digital transformation, 35M+ population with 70% under 35, BNPL growth of 60% YoY, $40B+ remittance volume, and rising digital payment adoption — presenting major opportunity for foreign fintechs.

1. Young, Digitally-Driven Population

35M+ population

Over 60–70% under age 35

High smartphone adoption and digital banking usage

Result: Rapid adoption of digital wallets, BNPL, remittances, and neo-banking.

2. Vision 2030: A Government-Driven Financial Revolution

Saudi Arabia is not waiting for financial innovation — it is actively legislating and funding it.

Key initiatives shaping the market:

InitiativeImpactSaudi Fintech Initiative & funding programsCapital & licensing supportOpen Banking FrameworkMandatory APIs & interoperabilityRegulatory Flex-SandboxControlled fast-track for new fintech modelsDigital Payments MandateCashless shift across government servicesForeign investment & tax incentivesEncouraging global entrants

The result is a policy-backed, innovation-friendly environment designed to attract foreign players who can bring technology and expertise.

3. Underserved Segments with High Growth Potential

Opportunities exist across multiple domains:

1) Payments & Fintech

Cross-border remittance (~US$40B+ annual flow)

Digital wallets adoption booming

BNPL growing >60% YoY

Embedded finance in early phase

2) Banking

Digital banks emerging

SME banking demand rising

Islamic finance product innovation

Wealth management for affluent demographics

3) Insurance

Insurtech penetration still low (~2.8% of GDP)

Embedded & micro-insurance opportunities

Health insurance growth driven by regulation

This is a market where demand exceeds supply — ideal for new entrants.

4. GCC Expansion Hub

Success in Saudi often becomes a launchpad to:

UAE → Kuwait → Bahrain → Qatar → Oman

Saudi sets regulatory tone for the region — win here, scale across GCC more easily.

The Reality: Massive Opportunity Comes with Regulatory Complexity

Many European and American fintechs enter Saudi assuming compliance transferability.

It doesn't transfer automatically.

Saudi Arabia emphasizes data sovereignty, localization, and regulator visibility far more strictly than EU/US frameworks like GDPR or DORA.

What Exactly Is SAMA?

SAMA = The Saudi Central Bank

Regulates:

Banks & digital banks

Fintech & payment service providers

Insurance companies

Remittance & FX platforms

Credit bureaus

Finance companies

Open-banking & payment institutions

If you handle financial data or money in Saudi Arabia — SAMA regulates you.

Why Foreign Companies Are Often Surprised

1. Data Localization Is the Default, Not the Exception

In the EU:

Data can move cross-border if safeguards exist (SCCs / adequacy / BCRs)

In Saudi:

Financial & personal data must be stored and processed inside the Kingdom. Cross-border transfer is allowed only with strict justification and controls.

This changes cloud strategy, architecture, IR/DR planning, and operational models.

2. Cloud Deployment Must Be Saudi-Specific

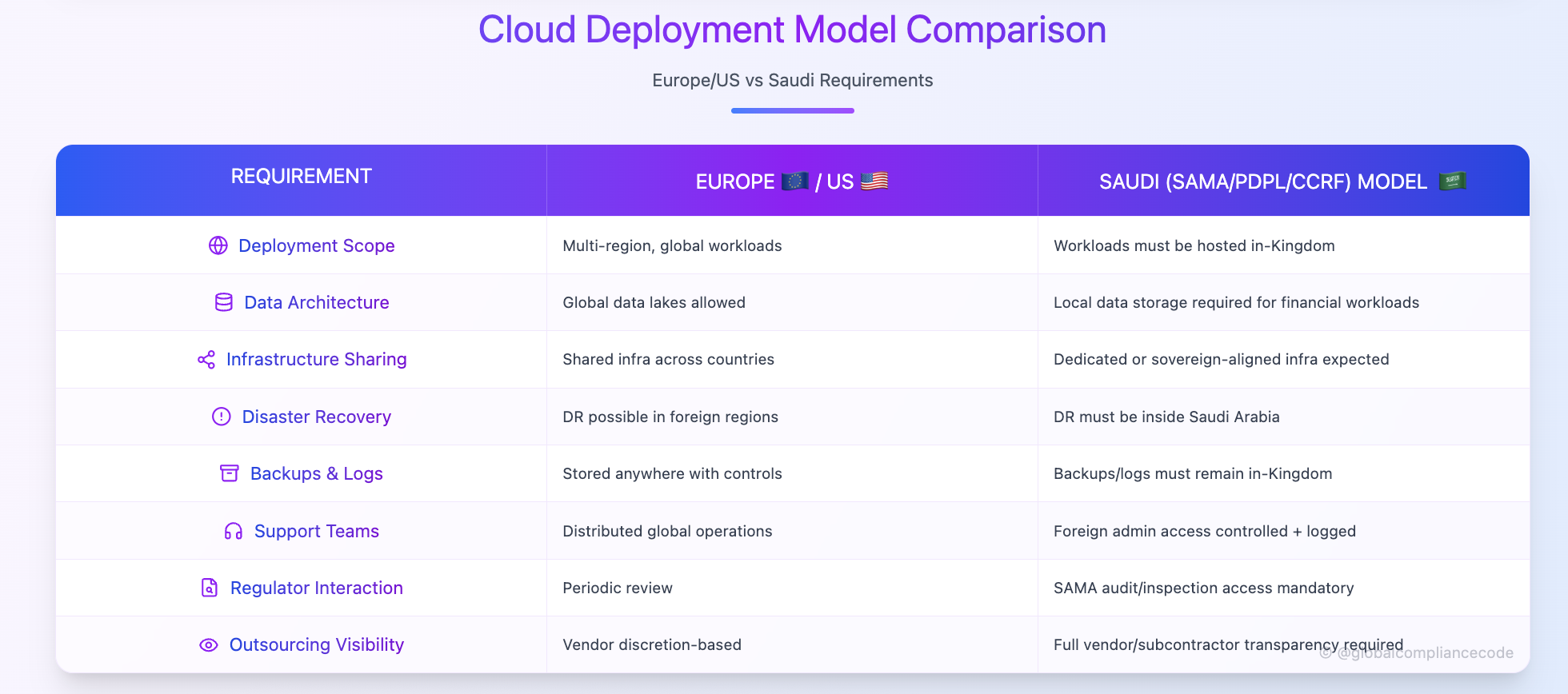

Europe/US cloud models can span multiple regions globally — but Saudi compliance requires data, logs, backups, DR, and operational control to remain inside the Kingdom with regulated oversight.

What works in Europe/US:

Multi-region architecture

Global data lakes

Shared infra across countries

DR outside region

Support teams distributed internationally

What Saudi expects:

In-Kingdom hosting for financial workloads

In-Kingdom backups, logs & DR

SAMA access for audit and inspection

Foreign admin access must be controlled, monitored, logged

Vendor & subcontractor visibility mandatory

This is not a simple lift-and-shift — it requires architectural redesign.

The Core Regulatory Pillars You MUST Understand

The Core Regulatory Pillars You MUST Understand

Foreign entrants must assess compliance readiness across five key frameworks:

Note: CCRF is issued by CST, not SAMA — but SAMA requires financial institutions to comply with it, making it critical for cloud deployments.

SAMA vs DORA: A Helpful Comparison for European Companies

DORA (EU) vs Saudi SAMA + CCRF/PDPL compliance requirements comparison for cloud service providers and financial companies.

Highlights key differences in data residency, disaster recovery expectations, log/backup location requirements, outsourcing controls, and foreign administrator access rules.

Common Mistakes Foreign Entrants Make

❌ 1. Building in UAE/Bahrain and routing Saudi users through it

Licenses get delayed — often forced to rebuild inside KSA.

❌ 2. Presenting ISO 27001 / PCI as “enough”

They are baselines — not substitutes for Saudi-specific requirements.

❌ 3. Treating compliance as post-launch work

SAMA expects detailed architecture, data flows, DR evidence, vendor governance upfront.

Delays often add 6–18 months of cost and redesign.

Cost vs Reward — Is It Worth It?

Typical investment ranges for serious entry:

But ROI potential:

Access to US$1T+ financial sector

High-value premium customers

Early-stage competitive landscape

GCC expansion multiplier effect

For committed players — the business case is strong.

Key Takeaways

1. Saudi is one of the most important financial markets of 2025–2030

Big, young, digital, high-value.

2. SAMA operates differently from EU/US regulators

Localization & sovereignty first — not portability.

3. EU/US compliance is helpful but not enough

DORA/ISO/PCI ≠ ready for licensing.

4. Build Saudi architecture from day one

Not “extend later” — design for in-Kingdom from start.

5. Compliance is a competitive advantage

Those who adapt early scale fastest.

Final Thought

Saudi Arabia is not just another expansion market — it is the financial transformation hub of the Middle East. Growth is accelerating, capital is flowing, and the regulators are actively shaping a secure digital ecosystem.

Companies that understand SAMA early, localize architecture, document rigorously, and invest properly won’t just enter the Kingdom — they’ll become strategic partners in its financial future.

And in this market — that’s worth the effort.

References & Source Materials:

Saudi Central Bank (SAMA) — Cybersecurity Framework

Personal Data Protection Law (PDPL)

National Cybersecurity Authority (NCA) — Essential Cybersecurity Controls (ECC-2)

Communications, Space & Technology Commission (CST) — Cloud Computing Regulatory Framework (CCRF)