UAE vs Saudi Arabia data residency: What tech companies need to know

UAE vs Saudi Data Residency:

What Tech Companies Need to Know

GCC data residency comparison chart: Saudi Arabia PDPL centralized strict-residency model vs UAE flexible multi-framework model (PDPL, DIFC, ADGM) with cross-border safeguards.

The $169B Opportunity: Why Data Compliance is Your Gateway to the Gulf's Tech Boom

The Gulf is rapidly becoming one of the world’s most dynamic engines for cloud, AI, and data-driven innovation. The UAE and Saudi Arabia are pouring billions into hyperscale data centers, sovereign cloud programs, and national AI strategies—while simultaneously tightening rules on where data lives and how it moves.

For tech companies, this combination is powerful and risky: the opportunity is massive, but data residency mistakes can quietly kill deals, derail launches, or trigger investigations before you’ve even hired your first local employee.

The pattern is almost always the same: they treated data residency as a legal problem, not an architecture problem.

This isn’t a legal guide. It’s a technical reality check on UAE and Saudi data residency—written for executives, architects, and compliance leaders who need to make real deployment decisions, not just update a privacy policy

1. Why Data Residency Is Now a Cloud Architecture Problem

In the Gulf, data residency is no longer a paragraph in a privacy policy—it’s a design constraint for your:

Cloud region strategy

Tenant and environment layout

Logging and backup patterns

AI training pipelines

Vendor and SaaS selection

Both countries want the same thing:

protect citizens’ data

maintain sovereignty

attract global tech investment

But they get there in different ways. The UAE leans toward flexible but fragmented, while Saudi Arabia is centralized and strict. Understanding that split early lets you avoid the classic trap: building one “Middle East region” and then discovering it satisfies neither regulator properly.

2. High-Level View: UAE vs Saudi Arabia Data Regimes

UAE: Flexible, Multi-Regime Landscape

The UAE runs on a three-layer model:

Federal UAE PDPL (Federal Decree Law No. 45/2021) – applies across the country

DIFC (Dubai) – its own GDPR-style regime with active enforcement

ADGM (Abu Dhabi) – another GDPR-style regime with its own rules

From a cloud perspective:

There is no blanket data localization rule for all sectors.

Certain verticals (healthcare, finance, government) have strict “in-UAE” requirements.

Free zones (DIFC/ADGM) can be stricter than the federal level, especially for cross-border transfers.

What this means for architecture

You often end up answering three questions:

Where is the company/entity legally based? (Onshore, DIFC, ADGM?)

Where is the processing really happening (which region, which vendor)?

Which customers fall under which regime?

If you mix these together in one big multi-tenant blob, you inherit the strictest rules from all of them.

Saudi Arabia: Single National Framework, Strong Residency Bias

Saudi Arabia runs under a single national framework:

Personal Data Protection Law (PDPL) administered by SDAIA.

The default position is simple, and tough:

Personal data should be processed and stored inside the Kingdom.

Cross-border transfers are possible, but only under tightly controlled conditions and, in many cases, with explicit approval and documented risk assessments.

On top of PDPL, you have sector regulations that hard-code localization expectations:

Government data → must sit with CST-registered providers in KSA.

Banking and finance → data stays in the Kingdom under SAMA (Saudi Central Bank) rules.

Insurance, employment, critical infrastructure → additional local retention and security rules.

Recent updates (like ECC-2 in 2024) relaxed some localization requirements for certain critical infrastructure entities, but they did not turn Saudi into a data free-for-all. Sector rules still bite.

What this means for architecture

For many use cases, you need:

Compute + storage in-Kingdom

Logs and backups also in-Kingdom

A clear story about what does and does not leave the country

For now, that often means on-premises or local hosting, potentially with Azure Arc or similar to keep management consistent until more local cloud regions mature.

3. Data Localization: Where Data Must Live

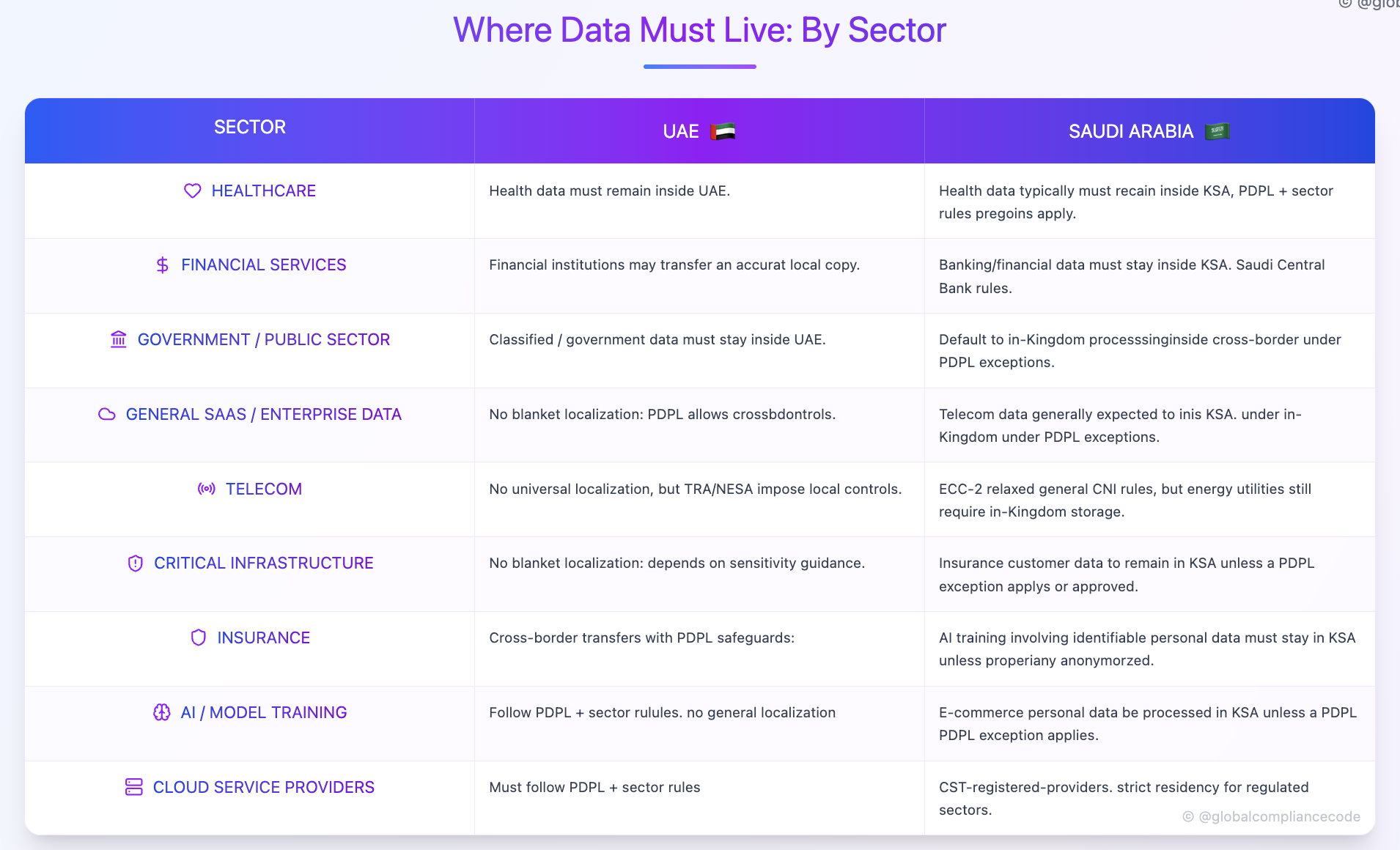

Sector-by-sector comparison of UAE vs Saudi Arabia data residency requirements. UAE PDPL allows conditional cross-border transfer, while Saudi PDPL defaults to in-Kingdom storage, especially for financial, government, critical infrastructure and personal data.

UAE Localization in Practice

For most generic SaaS or enterprise platforms, the UAE is relatively flexible, unless you hit specific vertical rules:

Healthcare – Health data must remain in the UAE; cross-border transfers need regulatory approval.

Financial services – Data can be transferred, but a complete, accurate copy must be kept in UAE.

Government / classified data – Must stay in UAE.

In addition, DIFC and ADGM operate their own “adequate jurisdictions only” model for transfers, similar to GDPR. Transfers to other locations (including onshore UAE) may require additional safeguards.

Technical implications

You can often use UAE-based hyperscaler regions (AWS, Azure, GCP, etc.) for general workloads.

For healthcare, finance, or government, you need strong guarantees that all primary and secondary data (including backups and logs) stay in-country.

If your company is incorporated in DIFC or ADGM, you operate under GDPR-style data transfer restrictions. You can only transfer data to jurisdictions with adequate protection—a short list that excludes the US, most of Asia, and even mainland UAE without additional safeguards like Standard Contractual Clauses

Saudi Localization in Practice

Saudi’s starting point is stricter:

Personal data = inside KSA by default.

Cross-border = exception, not the norm.

Additional overlays:

Government entities must use CST-registered providers physically located in KSA for cloud services.

Banking, insurance, and financial data must remain in KSA under sector frameworks.

Even where some critical infrastructure localization has been relaxed, you still need:

Clear risk assessments

Strong controls for any cross-border movement

Documentation showing how PDPL obligations are met

Technical implications

You design Saudi-specific environments, not just a UAE region with “Saudi customers” in a table.

Telemetry, logs, and derived data (e.g., ML features) also need to be considered “data,” not just the primary database.

You need a plan for cross-border edge cases: global support staff, central SOCs, global analytics, AI model training, etc.

Residency requirements touch storage, backups, logs, AI training, and vendor access — not just your primary DB. This checklist helps you validate your current design and identify gaps early.

4. Cross-Border Transfers: It’s Not Just About the Database

Both countries allow data to cross borders, but the guardrails differ.

UAE Transfers

UAE rules (and even more so DIFC/ADGM rules) generally permit transfers where:

The destination has adequate protection, or

You use Standard Contractual Clauses or similar mechanisms, or

You have a valid legal basis (e.g., contract necessity, public interest, consent).

From a cloud compliance angle, that means:

You can centralize some analytics and monitoring outside UAE, if you structure it correctly.

You still need to document: which data, to where, under what safeguards.

Saudi Transfers

Saudi PDPL takes a much more conservative view:

Transfers are prohibited by default.

Allowed only if specific conditions are met: contractual necessity, public interest, vital interests, or explicit SDAIA-approved mechanisms.

Risk assessments and documented safeguards are mandatory.

For cloud teams, that raises tough questions:

Can we centralize logging in a global SIEM?

Does our L2/L3 support model involve accessing Saudi production data from outside KSA?

Are we exporting training data for AI models?

You can often solve this by:

Pseudonymizing or anonymizing data before transfer

Keeping identifiable data in KSA and only exporting aggregates

Structuring support and monitoring so that detailed data stays local

But you need to design this in, not bolt it on later.

5. Cloud Infrastructure Reality: Regions, Hybrids, and Workarounds

UAE: Hyperscaler-Friendly

The UAE already has multiple cloud regions and strong hyperscaler presence. That means:

For many SaaS and enterprise workloads, a UAE region is a clean answer to residency concerns.

AI services (including regional data residency options) are becoming available inside UAE data centers.

Local residency + global reach is easier to design: UAE region for storage/processing, controlled outbound flows for global analytics.

Saudi: Growing, But Transitional

Saudi’s cloud story is evolving fast, but there’s a transition period:

Local regions are coming online (with full availability still ramping).

In the meantime, many serious deployments use:

Local data centers / colocation

Government or national cloud providers

Hybrid models (on-prem + Azure Arc / similar)

For tech companies, this often means:

Saudi is not “just another checkbox region.” It may need its own deployment pattern.

You’ll probably run a different stack shape in KSA (or a subset of features) until cloud region options fully mature.

Your product roadmap should acknowledge that Saudi may lag 6–18 months behind your EU/US feature set for certain advanced services.

6. Common Pitfalls for Tech Companies

Here are patterns that repeatedly cause trouble:

“We’re GDPR compliant, so GCC is easy.”

GDPR is a great baseline, but GCC rules are grounded in sovereignty and localization, not just rights and transparency.

Single “Middle East” deployment.

Combining UAE + Saudi into one region with shared storage creates complex, sometimes unsolvable, residency conflicts.

Ignoring free zones in the UAE.

DIFC/ADGM can be stricter than the federal level, especially on cross-border transfers and fines.

Under-scoping data flows.

Teams focus on the main production database but forget:

Backups and archives

Analytics warehouses

Logging and APM tools

CI/CD logs containing data snapshots

AI training pipelines pulling production data

Vendor assumptions.

“Our cloud provider says they’re compliant” doesn’t guarantee your architecture, configuration, and data flows meet local expectations.

7. Practical Design Patterns That Actually Work

If you’re planning to serve both UAE and Saudi customers, think in patterns:

Pattern 1: Separate Regional Tenants

UAE customers → UAE cloud region

Saudi customers → KSA-based environment (local DC or KSA cloud)

Enforce segregation at:

Account/subscription/project level

Database/schema level

Identity & access level

This keeps residency logic simple and defensible.

Pattern 2: “Data Stays, Metadata Travels”

For monitoring, analytics, and AI:

Keep raw, identifiable data in-region.

Export only:

Aggregates

Pseudonymized identifiers

Derived metrics

Document how each export path works, and why it doesn’t breach local residency rules.

Pattern 3: Residency-Aware Feature Flags

Some features might be safe for UAE but tricky for Saudi (e.g., global generative AI analytics on user content).

Solve this by:

Tagging features that involve cross-border processing.

Gating them by:

Jurisdiction

Sector

Customer risk appetite

You avoid “all or nothing” decisions and can evolve capabilities as regulations and infrastructure mature.

8. UAE & Saudi Arabia Data Residency FAQs

1) “Can we transfer our data from Dubai to Abu Dhabi?”

Yes — but rules depend on the legal entity and regulatory zone. Onshore UAE, DIFC, and ADGM have different data transfer requirements.

If your entity is based in DIFC or ADGM, transfers may require adequacy, SCCs, or safeguards even when moving data inside the UAE.

2) “Our headquarters is in Dubai, and we have a branch in Saudi Arabia. Which data residency rules apply?”

UAE data is governed by UAE PDPL + applicable free-zone rules, while Saudi customer data is governed by Saudi PDPL + sector frameworks (SAMA, NCA ECC, CST CRF etc.). You must treat Saudi data as in-Kingdom by default, even if your main infrastructure is in the UAE.

3) “We’re an US company processing a very small amount of customer data in Abu Dhabi. Do we need to comply with ADGM data protection rules?”

Yes. Any processing inside ADGM triggers ADGM data protection obligations, regardless of data volume. Compliance requirements do not scale down based on dataset size.

4) “Can we store Saudi customer data in the UAE if we anonymize it?”

Yes — if the data is truly anonymized and no longer personally identifiable under PDPL definition. However, pseudonymized data is not considered fully anonymized, so it may still require in-Kingdom storage and residency controls.

5) “Can we transfer data from Saudi Arabia to the US for analytics or AI model training?”

Only under strict conditions — Saudi PDPL treats cross-border transfers as exceptional, not default. You must prove necessity, implement safeguards, and often require SDAIA-approved transfer mechanisms, risk assessments, and documentation.

6) “If our customers are in Abu Dhabi but our company is registered in Dubai, which law governs data?”

Both may apply. Entity location (Dubai/Onshore) → determines controller obligations. Data subject location (Abu Dhabi/ADGM) → may impose ADGM data protection standards. In mixed jurisdiction setups, companies must comply with the stricter regime.

7) “ Is it possible to have one cloud region serve both UAE and Saudi users?”

Technically yes — compliance-wise risky. A shared Middle East environment can create residency conflicts. Best practice for GCC architecture is:

UAE customers → UAE region

Saudi customers → KSA region

Avoid shared databases for regulated workloads

8) Do backups, logs, and telemetry count as “data residency”?

Yes — residency rules apply to all forms of data, not only production databases. This includes logs, analytics snapshots, AI training sets, DR copies, backups, audit trails, and monitoring outputs.

Technical Implications of UAE & Saudi Arabia Data Residency FAQs

Technical implications of UAE vs Saudi Arabia data residency and cloud architecture decisions.

Closing Thoughts

The UAE and Saudi Arabia are building some of the most ambitious digital and AI economies in the world. They want serious technology companies in the region—but on terms that respect sovereignty and local control over data.

For tech companies, that means:

Treating data residency as a first-class architecture decision

Designing separate, jurisdiction-aware deployments rather than one “Middle East” blob

Understanding that compliance is now deeply technical, not just a legal checkbox

The companies that win this market will be the ones whose engineers, architects, and product leaders internalize these rules early, and build systems that are not only innovative—but also residency-ready by design.

References & Source Materials:

Saudi Central Bank (SAMA) — Cybersecurity Framework

Saudi Data & AI Authority (SDAIA) — Personal Data Protection Law (PDPL)

National Cybersecurity Authority (NCA) — Essential Cybersecurity Controls (ECC-2)

Communications, Space & Technology Commission (CST) — Cloud Computing Regulatory Framework

Federal Decree-Law No. 45 of 2021 — Personal Data Protection Law (UAE PDPL)

DIFC Data Protection Law (Dubai International Financial Centre)

ADGM Data Protection Regulations 2021 (Abu Dhabi Global Market)

UAE Sectoral Requirements — Healthcare, Financial Services & Government Data Residency

*Note: This content is for technical readiness and compliance planning purposes only and does not constitute legal advice.*